Sommaire

- Developments in Container Closure Integrity Testing of Lyophilised Product

- Development of Platform Processes for the Manufacture of Biopharmaceuticals

- Minimiser les risques de la chaîne de la valeur dans le domaine de la santé

- Propositions de modifications spécifiques de l’Annexe 1

- La qualité et la stérilité du produit fini d’un process B.F.S.

- Création d’un Groupement d’Intérêt Commun A3P B.F.S. ?

- Fully automated Particle Inspection in Blow Fill Seal Containers – A new approach

- Principes du lavage automatique et erreurs courantes

- Four strategies to improve competitiveness in the pharmaceutical and medical device industries

- Management – Quelques pensées sur la direction de sites et le leadership, Partage d’expérience et de petits trucs…

After decades of major discoveries and breakthroughs, the pharmaceutical and medical device industries have reached a consolidated and mature stages that are characterized by increased (direct) competition, reduced levels of disruptive innovation typically not stemming from large, established players, increase of cost and performance pressure, and high degree of market saturation.

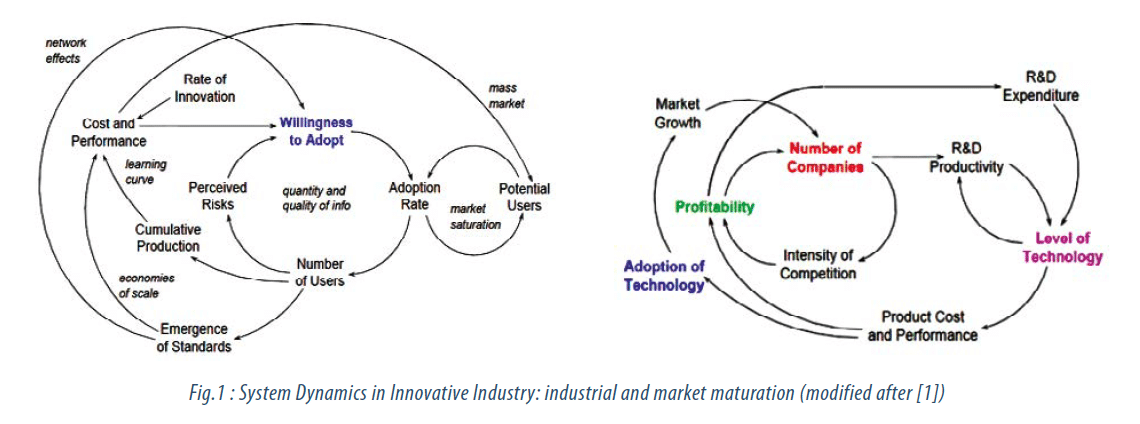

This development is a generic maturation cycle that occurs in any type of industry, and its system dynamics is well explained in [1], where variables playing a role are depicted in Fig.1. Many drug products (DPs) and medical device products (MDPs) are becoming commodity products. Major players have a continuous and ongoing need to increase their R&D spending and to focus more and more on cost efficiency. Prices on the market are eroding (generics, low-cost substitute products, many times appearing after expiration of the underlying IP) which leads to continuous profits reduction. Regulations and standardization have increased, and number of major players on the market typically lies between 5 and 10. This market / competition maturation stage is typically accommodated by a consolidation of the market players through M&As. In 2013 and 2014 we were faced with several executed, undergoing, or targeted market consolidations, exemplified in following cases: JNJ and Synthes, Medtronic and Covidien, Zimmer and Biomet, Pfizer and AstraZeneca (until now unsuccessful), GSK and Novartis. Major players are thus seeking ways to counteract and manage market / industrial dynamics via standard approaches that usually leave only 2-4 winners surviving on the market until typically new players manage to overrun the old players, which leads to emergence of a new dynamical cycle that again starts evolving at an initial state.

Instead of letting the company to be pulled into a threatening abyss (uncontrolled dynamical evolution in a negative state), what are then the best strategies to survive at this maturation stage and furthermore, to evolve and advance as a winner into a new cycle of innovative industry ?

| Résumé Les industries de pharmaceutiques traditionnels et de dispositifs médicaux sont sous une pression croissante d’une gamme de tendances liées à la haute maturité de leurs lignes de produits et de technologies conventionnelles. Ces tendances comprennent : ceux vers des prix de marchés en baisse pour des produits délivrés avec une meilleure qualité et performance (donc avec des coûts de R & D et de fabrication plus élevés), les tendances de saturation du marché avec peu d’acteurs établis rivalisant principalement sur le coût, ainsi qu’une tendance forte d’exigences réglementaires de plus en plus strictes et coûteuses, et finalement un niveau réduit des innovations de rupture. Une manière d’adresser ces défis est d’augmenter les dépenses en R & D et de se concentrer de plus en plus sur l’efficience et la réduction des coûts. Cependant, ces approches classiques ne permettent pas de résoudre des défis majeurs, car les profits sont en baisse en raison des baisses des prix sur les marchés, et les entreprises fournissent généralement seulement l’innovation incrémentale. Les acteurs principaux adressent ces tendances et la dynamique du marché par des approches traditionnelles qui laissent seulement un ou deux gagnants, alors que le marché arrive à saturation à cause de la consolidation de grands acteurs. Ainsi, l’industrie pharmaceutique et médicale – à ce stade de maturation – avance dans un environnement concurrentiel de plus en plus dure et un nombre croissant de fusions et d’acquisitions a lieu. Dans ce court article nous présentons les meilleures stratégies pour survivre à cet état de maturation et évoluer en tant que gagnant dans un nouveau cycle de l’industrie innovante. Nous vous proposons 4 stratégies qui permettraient d’améliorer la compétitivité dans l’industrie pharmaceutique et l’industrie de dispositifs médicaux: 1) Augmenter des investissements en R&D afin de renforcer les départements de l’innovation et de la technologie en adoptant une gestion moderne de l’innovation pour se concentrer sur le développement de produits de rupture et de favoriser la différenciation des gammes de produits, 2) Améliorer l’efficacité interne (time-to-market, réduction des coûts) par la normalisation et la maturation des processus d’affaires et de développement, 3) Sélectionner un processus de développement de produit optimal en fonction des évolutions de rupture ou incrémentielles / différenciation des nouveaux produits et 4 ) Suivre en permanence les innovations technologiques. |

One strategy that companies apply – when in position to do so – is an increase in the R&D investment (Strategy 1). In a mature industrial stage this however only leads to incremental innovation on products. Like this the established players can stretch out their time-duration of certain market leadership and can resist for a while the emerging competition of newcomers. Typical examples of this comprise: improvement of retardant release action of drug products like capsules and tablets, improvement of drug stability / shelf-time, improved coatings and surface treatments of tooth or bone implants that are promoting oseointegration. What companies shall do is to strengthen their innovation and technology departments (by adoption of modern creativity, innovation and technology management methodologies) and to focus on disruptive new product development (NPD), best achieved in spunoff sister companies (separation of budgets and decision making) or in the mode of “Open Innovation” (see also Strategy 4 below). Mature players are normally just too busy with the current operations and with incremental improvements. Their increase in R&D spending typically does not leverage and does not result in major improvement of the business / product portfolio [1, 7].

Examples of more disruptive product innovations where Altran is assisting with incumbent product development are: tissue engineered “drug products” (incorporating e.g. growth factors or factors that modify cell repulsion and attraction), microtechnology based manufacturing of deep brain stimulation electrodes having much larger selectivity of brain tissue activation, magnetic steering of heart ablation catheters used in treatment of heart arrhythmias, and development of combination products (CPs). Both types of industries (medical device and pharmaceutical) have correctly identified combination products as NPD strategy that is quite disruptive and that can thus give them a larger innovative boost and competitive advantage over other players. Examples of CPs range from simpler prefilled or reconstitution syringes, electronic inhalers with intelligent sensing, user biofeedback, and wireless connectivity, to more disruptive ideas of cochlear implants combined with drug delivery for transdifferentiation of ganglionic hearing cells into sensory primary hair-cells and/or neuroprotective drug delivery. CPs bring two advantages to the industries: A: increased value proposition along the customer value chain (improved diagnostics, improved delivery / therapy, personalized medicine (increasing likelihood of success), improved patient compliance to name a few), and B: since the life-cycle of NDPD is much longer that the NPD of medical devices, it is much faster to integrate additional customer value proposition into CPs than into pure DPs.

Another typical way to improve internal efficiencies and reduce total cost are improvements in processes governing business operations (Strategy 2). Maturity of NPD, supply chain, manufacturing and QA processes can be described by the CMMI methodology developed by Carnegie Mellon University in Pittsburgh, USA. Maturity levels typically evolve from level 1 (no or few processes established and described) to levels 4 and 5 characterized by established KPIs, benchmarking, and continuous process improvements (optimization) that leads to improved performance (reduced cost and faster time-to-market). Efficiency in product development is improved by standardization of the process (lower variability of the process, faster lead and throughput times, lower fault and failure rates, improved information flows (clear process ownership, RACI matrix for information exchange and improved decision making), increased concurrent engineering execution of the development). Articles [2] and [3] discuss and devise ways how to reduce lead-times of NPD while still avoiding risks of design errors, redesign, and rework.

Process and quality system maturity is also linked to regulations that impose a minimum set of (essential) requirements through laws (such as US CFR, EU MDD) and that also guide the industry through international standards and recommendations (e.g. FDA guidance documents such as documents on GMP or process validation). Product developers and manufacturers need to comply with regulations that are also dynamic and evolving. Regulatory compliance is challenging for newer players (start-ups and SMEs) and protects major players up to a certain degree (barrier to entry / cost of process and quality system establishment). While smaller players and newcomers have more often compliance gaps due to lower experience and lower maturity, larger players also show gaps when the products are evolving beyond their commodity products (as in case of CPs, where pharmaceutical industry now also needs to comply with MDD regulations and vice versa). Establishing and keeping up with the basic regulatory compliance levels is already not a simple task and takes time. In case of medical device NPD, several articles were published that have studied and developed comprehensive processes and process models [4,5,6]. These can be used as generic reference models in the industry and can easily be adopted and customized to individual needs of each company.

For improvement of internal efficiency, timeto-market, and cost reductions, process reengineering and optimization still plays an important role (CMMI 4 and 5 levels). Altran has recently mapped and reengineered a technology transfer process for a major pharmaceutical company, and this type of internal and external consulting projects are common in mature industries. However, obtained optimizations result in incremental improvements within the same business models, where earnings are optimized due to cost reduction and increased efficiency. For more disruptive innovation, business models and business ecosystems need to undergo a major change that will bring true new customer value proposition to live. Some examples and tips for medical device and pharmaceutical companies are given in [9].

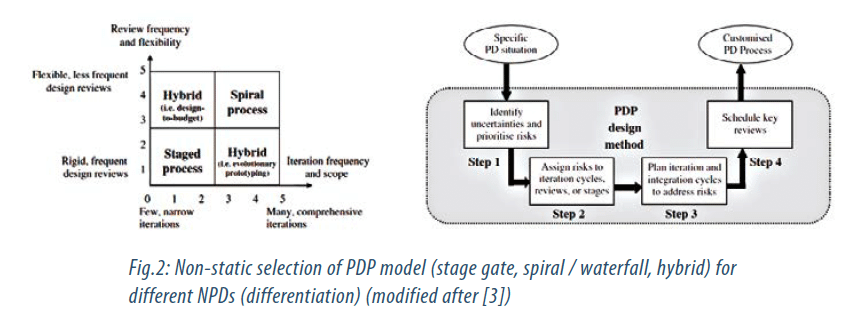

Coming back to the product development, what we as a NPD and technology consulting company observe in practice are certain issues (inefficient development and product quality problems) that are typically not well addressed in the industry and are occurring in spite of well established and mature processes (that have no or low levels of compliance gaps). These problems are more linked to actual NPD and arise as companies typically select one type of PDP only – and stick rigidly to it.

This leads to problems as a single PDP type is not optimal for different types of NPD / products (optimal choice depends e.g. on the disruptive or incremental nature of the product evolution). Selection and freeze of a single PDP type, thus, reduces flexibility needed for evolutionary type of product development, which is often most needed with introduction of new technologies (these problems are linked to products whose development possesses a larger risk) [3]. The above observations add another dimension in the process modeling / development and devises a third strategy for industry to achieve greater competitive advantage (Strategy 3).

A proposal how to address and dynamically select the right NPDP based on product technology / risk assessment is shown in Fig. 2.

Strategy 4: To be prepared for surprises with more innovative / disruptive competition, major players also need to continuously monitor technological and innovation landscapes. They need to identify incumbent technologies and products, their cost and performance dynamics [7], and their adoption degree. Monitoring needs to comprise R&D that is conducted at universities, research institutes, and start-ups (technology scouting). An advanced web-based IT tool for innovation and technology management (IMPA) was recently developed [8]. Examples of recent disruptive developments are, e.g., cell based cancer therapies or examples from synthetic biology where internal cell biology is modified / engineered in a sense that makes cells produce the desired concentrations of target drugs / molecules as a drug treatment substitute that works with internal and external control loops in-situ (covering sensing via receptors, cell signaling, and regulation of gene expression). Vision of the obsolescence of pill-taking has thus already been born, whereby drug intake will be substituted with an implantation of engineered cells providing desired system-regulation in a closed-loop fashion.

Sašo JEZERNIK – ALTRAN

saso.jezernik@altran.com

Partager l’article

Références

[1] HB Weil, JM Utterback: The dynamics of innovative industries. MIT Sloan School of Management Working Paper, MIT, Cambridge, USA, 2005.

[2] V Krishnan, SD Eppinger, DE Whitney: Overlapping Product Development Activities by Analysis of Information Transfer Practice. MIT Sloan School of Management Working Paper # 3478-92 MS, MIT, Cambridge, USA, 1992.

[3] D Unger, S Eppinger: Improving product development process design: a method for managing information flows, risks, and iterations. Journal of Engineering Design, Vol.22:10, pp.689-699, 2011.

[4] ICT Santos, GS Gazelle, LA Rocha, JMRS Tavares: An ontology model for the medical device development process in Europe. In Proceedings of the 1st Int. Conference on Design and Processes for Medical Devices-PROMED, Brescia, Italy, 2012.

[5] Lourdes A. Medina, Gül E. Okudan Kremer & Richard A. Wysk: Supporting medical device development: a standard product design process model. Journal of Engineering Design, Vol.: 24:2, pp. 83-119, 2013.

[6] JH Linehan, E Pate-Cornell, PG Yock, JB Pietsch, LA Shluzas: Study on Medical Device Development Models. Final Report. InHealth, Stanford University, 2007.

[7] Clayton M. Christensen: The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail. Boston, USA, Harvard Business School Press, 1997.

[8] Altran’s Web-Based Innovation Management Platform IMPA (2013): www.altran.ch/impa

[9] Clayton M. Christensen, Jerome H. Grossman, Jason Hwang: The innovator’s prescription: a disruptive solution for healthcare. McGraw-Hill, 2009.